Estimated reading time: 3 minutes

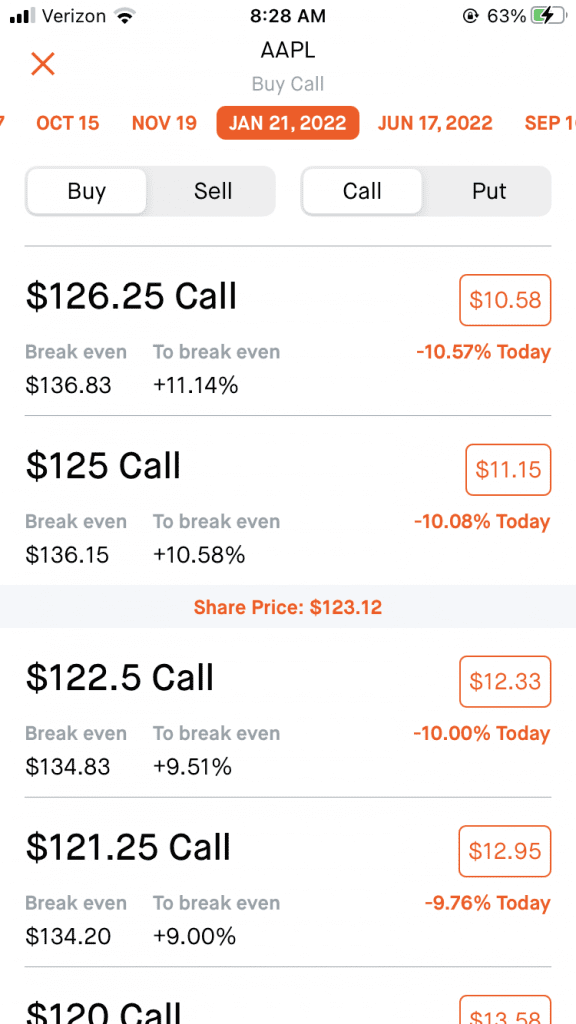

May 12 Price $11.10

Apple Price – $122

To option or not to option

When I was first researching stocks a few years ago, all these media outlets always claimed super high returns on stocks that they had picked. One claimed over a 200% return in the last 3 years whiles others where more lucrative. But one thing that I was never to find was the receipts. Anyone can claim that their picks from last year made a 100% return. It’s even easier when you are constantly pushing out so much content that one can never find actual articles from them to back their claim.

That’s why I’m creating The Option Move. All future articles will link back to this opening article so you’ll be able to trace the progress of this move, good or bad. I don’t claim to be some sort of stock market genius. In fact, I would say that my knowledge is rather limited. I like to keep it simple and straightforward since finances are hardly ever like that. This is also not a recommendation for you to buy whatever I talk about. People should always conduct their own research before investing in any company.

Options or stocks

But anyways, I like to keep it simple. I like options because you can get a higher return, or larger loss, compared to buying stock. It just always seemed too risky to buy into volatile stocks. Companies in the pharmaceutical industry or start-ups with an interesting idea seemed like a big risk that I wasn’t willing to take. Of course, I’m not saying that’s the wrong strategy. I know some people that have made a ton of money doing that.

Even though, options are more risky than stocks, there are ways to lower that risk. I tend to favor big companies since there’s a smaller chance of them losing value. So my go-to’s when it comes to options are Apple, Disney, and AMD. It’s not limited to just these companies but these provide an accurate picture of what I consider big companies. The riskiest one here would be AMD since they have serious competition with AMD but they have stood their ground.

New Apple products should drive revenue higher

Anyways, I digress. I like this Apple option. Their reports are great and they are releasing some really interesting products. The Apple AirTags and the redesigned Apple iMac are the two biggest reasons I’m favoring Apple options. And that is just scratching the surface of it. Their new processing chips are something that could really change the game.

Their decision to stray away from Intel and develop their own processing chips has been met with great optimism. The dubbed M1 chip has been debuted with the new MacBooks and the performance has been exceeding everyone’s expectations. The redesigned iMac’s will also feature these Apple processing chips so there is an understandable hype for them.

Brick-and-mortar making a comeback

The Apple AirTags are targeting the age-old problem of losing your wallet or keys. The great thing about them is that they are small and minimalistic and have some cool features.

And as we begin transitioning into less restrictive guidelines, the retail revenue may spike slightly. Everything seems to be pointing to a nice second half of 2021 for Apple.